When a streaming service offers a deal on multiple months of service, they’re clearly hoping you won’t bother to cancel once the discount period is up.

So here’s a way to fight back: Instead of using your regular payment method, sign up with limited-use credit card through Privacy.com. With this free service, you can create virtual credit cards that each have their own spending limits, letting you avoid bill shock when your promotional period is over.

Right now, for instance, Hulu + Live TV is offering new and returning subscribers a $20-per-month discount for three months of service, bringing the price to $50 per month. A virtual card would prevent Hulu from charging you any more than that amount, so you can rest easy knowing you won’t get auto-billed at the regular $70 rate a few months from now.

How to use virtual cards for streaming services

Here’s how to start creating virtual cards:

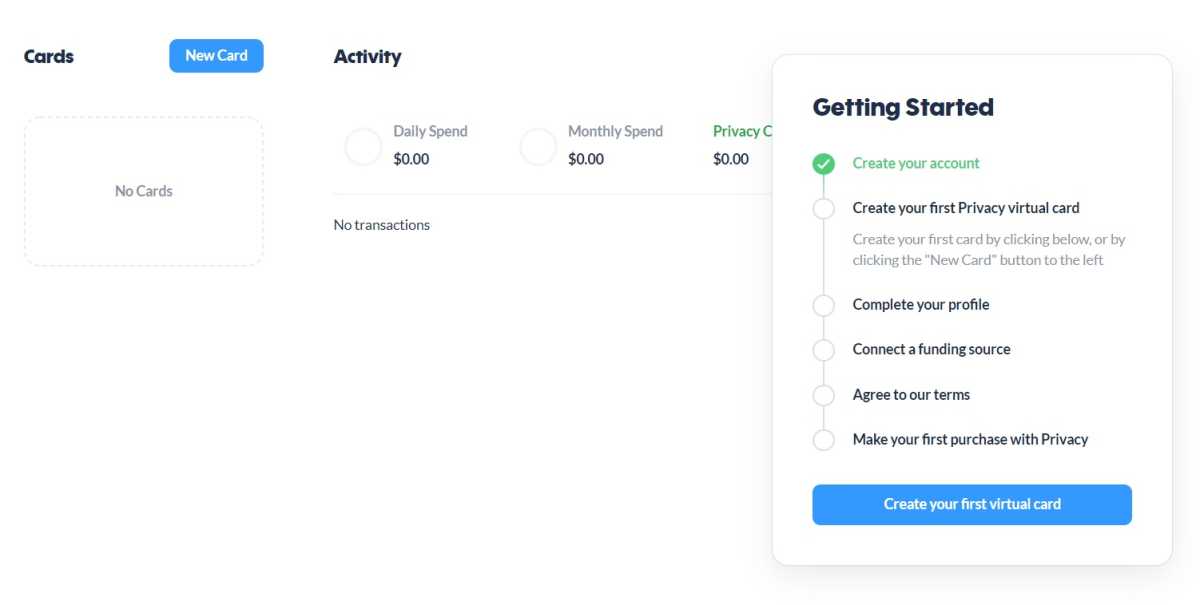

- Head to Privacy.com and select “Get Started.”

- Enter your email address, create a password, then check your email to verify your account.

- Back on Privacy.com, select “Create my first card.”

- Give your card a name, set a spending limit (which you can modify later), then connect a funding source.

Jared Newman / Foundry

As part of the initial setup, you’ll need to enter your name, address, phone number, and the last four digits of your social security number. That might seem unnerving, but it’s necessary to comply with financial regulations.

After providing those details, you can connect the service to your bank account. Just choose your bank from the list, then follow the setup steps to log into your account. Privacy.com uses a service called Plaid to connect with your bank, and does not store your bank’s login credentials.

Once you’ve created a card, simply copy and paste the card number, expiration date, and security code into your streaming service’s payment form, and Privacy.com will take care of enforcing your spending limits.

Setting your streaming spending limits

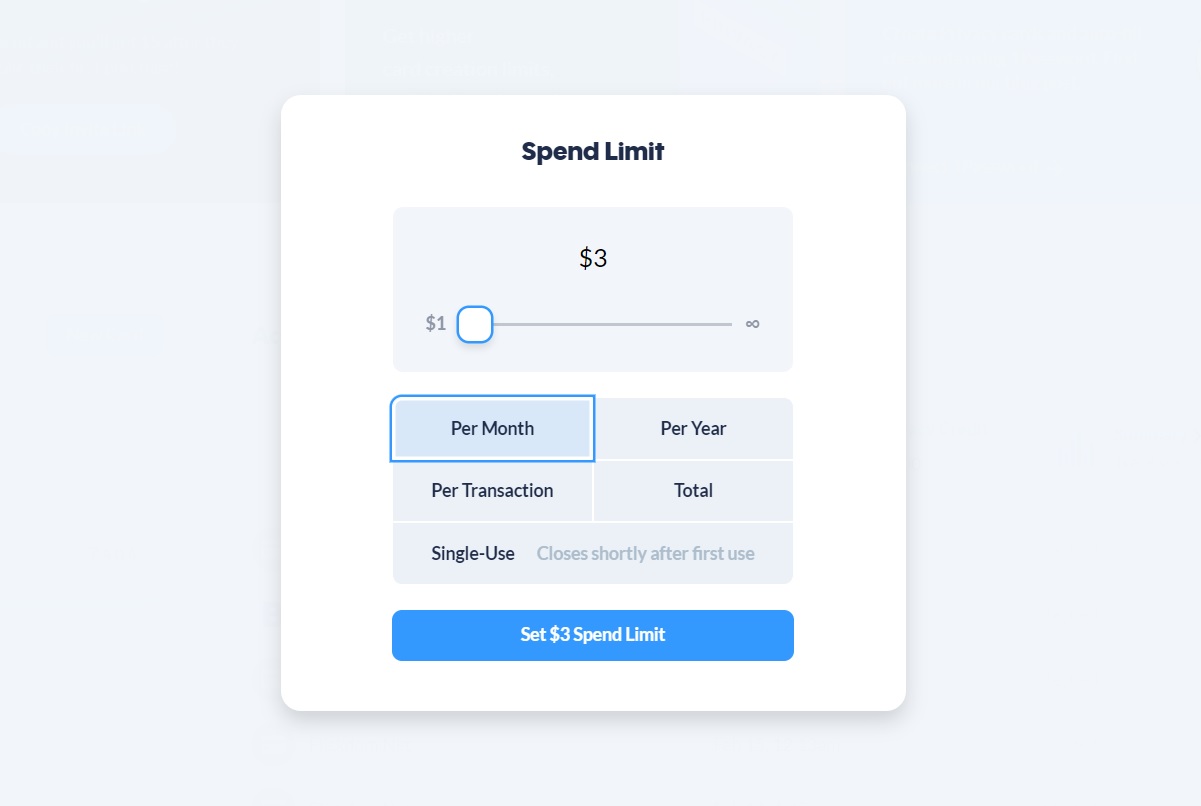

When creating a card, the trick is to figure out what sort of spending limits to create. To that end, Privacy.com offers a handful of options:

- Limited amount per month

- Limited amount per year

- Limited amount per transcation

- Total spending limit

- Single-use

Jared Newman / Foundry

Going back to our Hulu + Live TV example, you could set a monthly limit of $55, which is the base price plus enough to cover sales tax (if applicable). After the three-month promo period is over, Hulu would attempt to charge you $70, fail due to insufficient funds, and cancel the subscription automatically.

Alternatively, let’s say you wanted to keep Hulu + Live TV through the end of football season. In that case, you could set a total spending limit of $315, which would cover three months at the promotional rate and two more months at regular price. At that point, Hulu would fail to charge your card for another billing cycle, and your subscription would end with no further intervention on your part.

Just one caveat: Make sure you don’t have any other payment methods on file when using a virtual card. That way, there’s no risk of being charged on a different card after Privacy.com fails.

More uses for virtual cards

Hulu isn’t the only service for which a virtual card might be useful. As of this writing, for instance, Peacock is offering up to a year of Premium service for $2 per month, and we’re sure to see some similar multi-month deals as the holidays approach. For each service that’s offering a discount, you could create a separate virtual card to keep costs under control.

Even for regularly-priced services, a virtual credit card can help you evaluate your TV spending. You might, for instance, give yourself a six-month budget for Netflix, then reconsider whether it’s still worth a subscription when your virtual card stops working.

Privacy.com lets you create up to 12 virtual credit cards per month at no charge, which should be plenty unless you’ve really gone overboard with streaming services. But if you do need more than that, the site offers a “Pro” tier for up to 36 cards per month, plus some extra perks such as cash back.

Privacy.com vs. other options

Privacy.com isn’t the only way to limit your streaming spending.

For years, I’ve recommended cancelling streaming services immediately after sign-up, as you’ll still get the billing period you paid for, and won’t get auto-billed at the end. This is still a viable strategy, but only if you’re looking to subscribe one billing cycle at a time.

You may also be able to use prepaid debit cards or gift cards to sign up for streaming services, but some services don’t allow for this, and setting them can be a hassle.

By comparison, using Privacy.com is pretty easy once you’ve gone through the initial setup—it even integrates with 1Password, so you can create cards through the password manager itself—and it’s extremely satisfying to see in action.

As an added bonus, Privacy.com sends you an email every time it completes—or denies—a transaction, so you’re never in the dark about which services you’re paying for and how much you’re paying for them.

The streaming providers themselves aren’t always so courteous.

Sign up for my Cord Cutter Weekly newsletter for even more strategies to lower your TV bill.